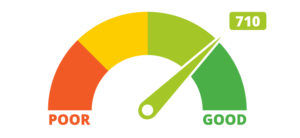

If you have a poor credit or no credit score, you’ll likely have trouble securing a loan facility from mainstream lenders. In other words, mainstream lenders typically assess your credit score to determine your capacity to default on a loan. For this reason, it is crucial to not only grow but also maintain your credit score. Here are 10 tips for improving your credit score to get you started.

lenders. In other words, mainstream lenders typically assess your credit score to determine your capacity to default on a loan. For this reason, it is crucial to not only grow but also maintain your credit score. Here are 10 tips for improving your credit score to get you started.

Check Your Credit Report

While your credit report may contain errors, it is your responsibility to ensure that the information in your credit report is accurate. Simply put, you should go through your credit report regularly to ensure it is accurate. It is worth noting that you are entitled to one free credit report annually from each of the major credit reporting companies in the US.

Go through Your Identification Basics

Once you have your credit card report, go through the basics. Ensure that your name, social security number and all the accounts listed are yours. An incorrect social security number is a severe discrepancy that could negatively impact your credit score.

Credit Secrets Facebook – Reducing Your Debt Burden

Debt repayment is probably the most challenging part about changing your credit card score. You need to stop using your credit card to avoid accumulating debt. Assess your debt burden and contact your creditors with the aim of creating a repayment plan. While at it, request your creditors to stop charging you interest on your existing debt to allow you to pay off your debt faster.

Creating Personal Payment Reminders

Banks and credit card loan providers may provide automatic messages and emails, reminding you of any payment that is due. However, it is still essential to have personal reminders that give you better money management skills. You should learn how to control finances personally and responsibly.

Always Pay Your Bills on Time

Paying your utility bills and credit card debt on time is a great way to maintain your current credit score. Instead of delaying payments and having your credit company send you a collecting agency, try to negotiate. Your credit company may agree to remove the unpaid debt and replace it with a payment agreement. This will not only keep your record clean but also maintain your current credit score.

Avoid Huge Credit Card Debt

If you are just trying to build your credit score, use credit cards for small purchases that you can pay off within 30 days. Avoid incurring huge credit card debt in an attempt to rebuild your credit score quickly. If you are planning to make a massive purchase such as a car, a house or a boat, it is safer to set up a savings account or build up your score to enjoy lower rates.

Credit Card Balance

Having a lower credit card limit is not a guarantee that your credit score will grow. For example, having a balance of $5,000 on a card with a $25,000 limit (20% used) is better than a balance of $1,500 on a credit card with a $2500 limit (60% used). Try to limit your balance to 30% for each credit card in order to improve your credit score.

Know When to Cancel a Credit Card

Cancelling a credit card could harm your credit score, meaning you should only do this with a valid reason. For example, if you are losing control of your spending habits, or cannot pay the increasing interest rates on a credit card, it is safer to close it to avoid debt. However, you can open a new account before you cancel your current account to keep your credit utilization ratio in check. It is important to remember that, if you have a weak credit score, canceling a card will hurt your score further.

Do not Close Your Only Credit Card

FICO credit score evaluates the diversity of your credit card accounts. A mix of credit cards increases your overall credit card score, and if you close the only credit account you have, you will automatically lower your score. While the history of the card remains functional for around ten years, its value diminishes over time.

Balance Transfer

A balance transfer allows you to transfer your debt from one lender to another. A balance transfer is particularly suitable when you want to save on interest payments charged by credit companies. However, there is always a balance transfer fee involved. Before applying for the transfer, make your assessment to determine if the move will save you money in the long run.

Conclusion

Making payments on time, regulating your spending, diversifying your credit cards, and strategically opening and canceling credit cards are great ways of boosting your credit score. With enough discipline, you can raise your score, and enjoy lower interest rates in the future. Visit http://www.washingtontimes.com/sponsored/credit-secret-mom/ to learn some more tips on how to improve your credit score.